Short-Rate Cancellation vs. Pro-Rata Cancellation: What’s the Difference?

Subscribe to our Blog

Nobody likes feeling as if they're stuck in an inflexible, binding contract — especially when it comes to insurance policies. But if a client could up and leave any time they wanted to without consequence, they'd constantly be bouncing around from insurance company to insurance company, scouring for the best rates.

On the other hand, insurance companies want to avoid being stuck in a contract with a client who has become uninsurable. For these reasons, cancellation policies are necessary for insurance companies' terms and conditions, so it's vital to be well-versed in the standard options: short-rate and pro-rata cancellations.

Let's explore what these cancellations mean for insurance companies and their clients.

What Is a Short-Rate Cancellation?

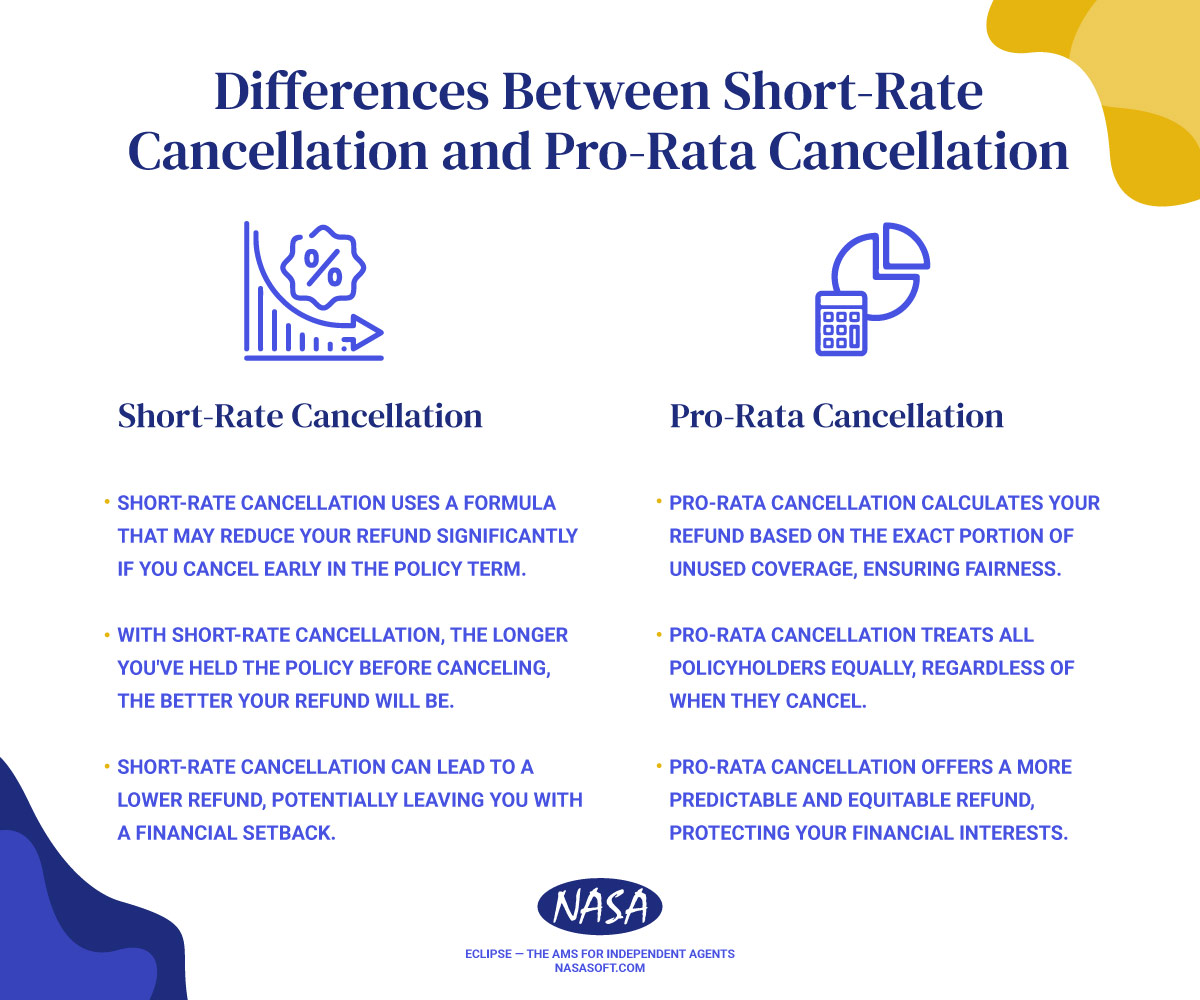

Short-rate cancellation occurs when a policyholder decides to terminate the insurance policy before the expiration date. In this scenario, the insurance company calculates the refund they are entitled to based on a formula that can be less favorable for the canceled policyholder.

The Short-Rate Cancellation Formula

Insurance companies typically use a formula that considers both time and risk to determine the refund amount for a short-rate cancellation. This formula involves charging a higher rate for the period the policyholder was covered than the standard rate for the same period. The longer they've held the policy before canceling, the more favorable the refund will be. However, if they cancel shortly after purchasing the policy, the refund will be substantially reduced.

Short-Rate Cancellation Example

Imagine you've purchased a one-year insurance policy with an annual premium of $1,200. After six months, you decide to cancel the policy. Instead of receiving a 50% refund of your premium (half of the annual premium), the insurance company calculates your refund using the short-rate formula. This might result in a refund of less than 50%, as the insurance company considers the administrative costs and underwriting expenses incurred during the short period you were insured.

What Is Pro-Rata Cancellation?

On the flip side, pro-rata cancellation operates on a more straightforward principle. When a policyholder cancels their insurance policy under a pro-rata system, the insurance company calculates their refund based on the exact portion of the unused coverage period.

The Pro-Rata Cancellation Formula

Under pro-rata cancellation, the formula is simple: Policyholders are refunded for the insurance coverage they didn't use. It's as equitable as it gets in the insurance world.

Pro-Rata Cancellation Example

Continuing with our example, if someone cancels a one-year insurance policy after six months, they would receive a 50% refund under the pro-rata system, which is half of the annual premium. The pro-rata approach ensures that policyholders are not penalized for early cancellation and receive fair reimbursement for unused coverage.

Key Differences and Considerations

Now that we've established the core concepts of short-rate and pro-rata cancellations let's highlight the key differences between the two.

What Determines Short-Rate Cancellation vs. Pro-Rata Cancellation?

It all comes down to who’s canceling the contract. If an insurer needs to cancel a policy early, then it stands to reason that the client would need their money back. It’s a simple quid pro quo — both parties receive a fair deal whenever a contract ends early.

However, when clients need to cancel a contract before the expiry date, companies have already spent time and resources managing their policies. So short-rate cancellation administrative fees cover these companies' costs to open, close and maintain the policy.

While some insurance companies don’t use short-rate cancellations, having that safety net can be an important financial buffer, depending on how many resources you’ve put into each contract.

Manage Cancellations With Eclipse AMS

While contracts can feel harsh, they’re crucial to doing business. No matter who needs to back out of a contract, there must be a mutual understanding of the financial consequences. So while pro-rata cancellations help clients stay flexible in their coverage, short-rate cancellations are there to lower your agency’s chances of sinking resources into squirrely clients.

If you need help managing cancellations, consider the Eclipse Insurance Agency Management System. With guidelines for short-rate cancellations and policy management tools, you can keep track of your insurance company’s policies with just a few clicks. Learn more about Eclipse today and give yourself a safety net for the unexpected.